Rate Cuts Delayed, Condos Tanking, Renewals Skyrocket.

- Gary McGowan

- Jul 22, 2025

- 2 min read

What do soaring rental construction, frozen interest rate expectations, and a weak condo market all have in common? They’re all signals from the July 2025 Edge Report that Canada’s housing market remains in flux, and the pressure points are shifting.

1. Rate Cuts on Hold: Inflation and Jobs Are Too Hot

In a twist few saw coming, the labour market came in strong—with employment up +83,000 in June, nearly four times higher than expected. That strength, combined with inflation creeping up (core inflation now brushing against 3%), has effectively killed the summer rate-cut narrative.

Ben Rabidoux writes, “My hopes for mortgages in the low 3s later this summer now look dashed.” With fixed mortgage rates hovering in the low 4s and bond yields climbing, buyers should brace for stubbornly high borrowing costs—at least through early fall.

2. Rental Construction Is Booming—But Is It Too Much?

Despite the headwinds, rental housing starts are exploding. In fact, 52% of June’s new construction was purpose-built rental—a record-breaking 11,000 units in one month alone.

CMHC now estimates that 7% of the entire rental stock is currently in the pipeline, a level that could spell trouble if demand doesn’t keep up—especially with international migration slowing.

3. Condo Sales Collapse: A 1990s Throwback

Toronto’s pre-construction condo market just hit a 30-year low with only 502 sales in Q2—levels not seen since 1993. Resale prices are now averaging 24% below the original pre-sale pricing.

This is locking many would-be move-up buyers in place. Without the equity growth they were banking on, that next home just moved further out of reach.

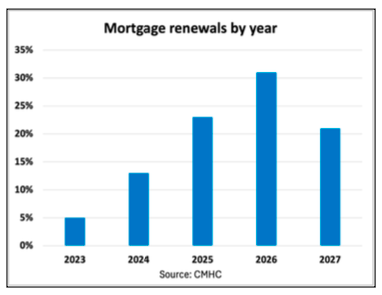

4. Mortgage Originations Surge, But Pain Looms

Surprisingly, May mortgage originations jumped 32% year-over-year. But hidden beneath that uptick is a looming wave of payment shocks tied to renewals.

Bar chart showing 15–20% hikes on 5-year terms; 40%+ for 2021 originations.

Histogram highlighting share of borrowers facing 20%+ and 40%+ increases.

Averages don’t tell the full story. As Ben puts it, “You never wade across a river that’s 3 feet deep on average.” It’s the borrowers at the far end of the curve who are most at risk.

5. Consumer Confidence: Up, But Still Bleak

While confidence ticked up modestly in June, it’s still stuck at levels we haven’t seen since the Financial Crisis. Consumers are worried about job loss, debt repayment, and holding off on major purchases.

Line chart showing a slight rebound from March lows but still far below norms.

Chart Title: Perceived Risk of Job Loss & Missed Payments

Bar graph showing job insecurity and financial anxiety trending upward.

Combine that with weak condo pricing and you have the ingredients for a soft market, especially in metros already facing excess inventory.

Final Thoughts

The big picture, as Ben Rabidoux puts it, is a story of delay: “This will eventually matter, but it won’t be this summer.” From rate policy to rental saturation and condo distress, much of what we’re seeing is the calm before a different kind of storm—or rebound.

Stay tuned, stay sharp, and if you’re an investor or buyer, keep your eye on the fundamentals—not just the headlines.

.png)

Comments